QuickBooks, a cornerstone for small and medium-sized businesses, streamlines financial management and payroll processing. In spite of its complexity, QuickBooks encounters errors that affect essential operational processes. QuickBooks error PS038 emerges as one of the most painful problems since it disrupts payroll functionalities particularly hard. The error blocks employee payment processing by appearing during payroll updates and sends or when payroll services need access. The successful management of error PS038 and its origins together with suitable troubleshooting techniques remains essential for businesses and accountants to operate payroll smoothly while staying compliant.

This thorough paper covers all complex aspects of the QuickBooks error PS038. This section starts with a full description of the error that explains its warning signals combined with how it affects operational business process. This section will analyze all potential causes behind error PS038 by examining both system configuration errors and corrupt data and connection difficulties that stem from outdated software versions and network problems. From the remedial know-how and assistance that follows, users will be taken step by step to restore payroll processing capabilities.

error PS038

Error code ps038– Unable to run payroll, please update QuickBooks and activate payroll

Overview of QuickBooks Error PS038

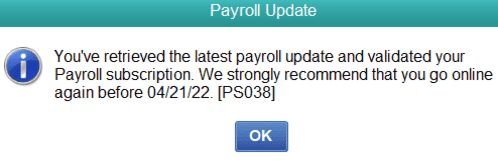

QuickBooks error PS038 confirms that your Desktop program is having a connection problem on the Intuit payroll servers. This disturbance is preventing the software from communicating with the Intuit payroll servers to carry out the payroll functions successfully. The users will notice a certain message when the error disrupts their operation:

- “QuickBooks Payroll Update Error PS038”

- While attempting to communicate with the Intuit Payroll service, an error was encountered. Please try again later. If the issue persists, get in touch with support to assist you with error PS038.

- Your payroll processing encountered an unexpected error that caused the system to malfunction. Error code PS038 appeared along with this message. Error code: PS038.”

Users encounter Error PS038 in different ways according to their current action in QuickBooks systems. The fundamental problem occurs when the software cannot maintain a reliable connection to the Intuit payroll infrastructure.

When a business faces QuickBooks Error PS038 it results in severe consequences. The payroll processing operation represents both a critical aspect and a highly urgent necessity. Not being able to download tax table updates results in both inaccurate tax calculations and potential penalties against the company.

A payroll data transmission failure would result in delayed worker compensation while breaking trust relationships and possibly creating problems with the law. The interruption generates obstacles which prevent payroll report generation thus causing problems for financial planning and compliance needs. The business needs an immediate solution of Error PS038 to prevent operational disruptions while maintaining normal system operations.

Causes of QuickBooks Error PS038

The first necessary step to fix Error PS038 starts with determining its core origin. Multiple elements function as causes for this connectivity issue. By determining the root causes it becomes possible to focus troubleshooting efforts and stop such issues from recurring. The reasons that trigger QuickBooks Error PS038 include these ones:

Damaged or Corrupted Company File

All financial data and payroll information stored in the business belongs to the ‘.QBW’ company file. The file damage along with corruption in this file creates PS038 together with multiple other system errors. System shutdowns combined with power outages during QuickBooks operation and software program failures result in data corruption.

Incorrect or Damaged Payroll Subscription Information

Any subscription failure or invalidity to QuickBooks payroll services leads to error PS038. An incorrect or damaged state of subscription information in the company file will block the software from authenticating with Intuit servers, thereby generating error PS038.

Outdated QuickBooks Desktop Software

The QuickBooks Desktop software receives frequent updates from Intuit to provide better performance and bug fixes together with support for updated payroll tax requirements. The connection between out-of-date QuickBooks and the Intuit servers causes error PS038 to occur.

Incorrect System Date and Time Settings

A correct configuration of date and time settings should be implemented on the computer that hosts QuickBooks. Systems with incorrect date and time settings will break secure server connections including those with Intuit payroll servers, thus causing authentication failures and error PS038 to occur.

Firewall and Internet Security Software Interference

Important system security features-like firewalls, for example-an antivirus program can wrongly deny connections of QuickBooks with its much-needed Intuit servers. Error PS038 may occur due to restrictive security software settings or possibly due to a minor glitch in the software.

Network Connectivity Problems

A quick and manageable Internet connection is the reason behind how QuickBooks functions. It enables access to the Intuit payroll servers. Communication between QuickBooks and Intuit payroll servers is denied during times of intermittent connections or slow network speeds in conjunction with network configuration issues, leading to error PS038.

Conflicting Third-Party Applications

Error PS038 may occur because other running applications on the same computer create conflicts with QuickBooks processing, which hinders its online service connection.

Damaged QuickBooks Installation

Damage to the QuickBooks desktop software or absence of essential files within its installation configuration leads to the error PS038 occurrence. The problem arises from flawed software integration and incompatible program interaction with system failure that results in various performance issues including payroll data connection troubles.

Intuit Server Issues

Occasionally the real problem with error PS038 resides within the Intuit payroll servers that serve the users. Error PS038 can occur when users access the servers during maintenance periods that cause server technical issues. The server problems generally create only short-term connectivity issues which disappear after the server issues are resolved.

User Account Control (UAC) Settings

The Use of excessive User Account Control (UAC) settings in Windows hinders QuickBooks from obtaining essential system resources needed for online communication which eventually results in error PS038.

Resolve QuickBooks Payroll Error PS038

A proper solution of QuickBooks Error PS038 begins with standard straightforward problem-solving strategies which progress to complex problem-solving if initial approaches fail to work. The following guide covers all aspects of this payroll connectivity issue in detail:

Verify Your Payroll Subscription Status

- Open QuickBooks Desktop.

- Navigate to the Employees menu.

- You need to access My Payroll Service followed by Account Info.

- Verify that your payroll subscription remains active together with its good financial health. You need to inspect both the expiration date along with all necessary description points.

- Contact the Intuit Payroll support group to handle subscription-related problems or expired payment situations.

Read More: Fix QuickBooks Desktop Subscription has Lapsed

Verify that your QuickBooks Desktop program runs the current version of the software available

- Open QuickBooks Desktop.

- Go to the Help menu.

- Select Update QuickBooks Desktop.

- Select all available updates from the provided list since this is the best practice.

- Click Get Updates.

- Your updates become ready after you end QuickBooks Desktop and restart the application to activate the changes.

Access System Settings to image Date and Time

- First of all, you need to make sure that the date and time that are shown on your system tray are correct.

- On the incorrect date or time, right-click and choose Adjust date/time.

- Select the correct date and time along with the appropriate time zone from the options.

- You can activate automatic time setting through the internet connection provided your computer maintains internet access.

Execute the QuickBooks Connection Diagnostic Tool

- Business users of QuickBooks will get the benefits of using a special tool called the QuickBooks Connection Diagnostic Tool. It will help them to troubleshoot connection errors within the system.

- Users should obtain the newest release of the tool by accessing the official Intuit website.

- Tool should be ran and followed on screen instructions to get the test ready. The user will be able to diagnose any issues related to your internet connection, firewall and QuickBooks settings.

- Recommendations or some of the problems detected maybe solved automatically with the tool.

Configure Firewall and Antivirus Software

- Check the error by disabling your firewall and antivirus application temporarily to find out if they are direct threats to the setup of QuickBooks.

- However, if the error vanishes once you turn them off, make sure that these programs are set up to let QuickBooks access the required Intuit servers.

- Refer to the documentation of your firewall and antivirus software for how to trust QuickBooks programs or create exceptions for the following QuickBooks executables:

- QBW32.EXE

- QBUpdate.exe

- QBLaunch.exe

- AutoBackupExe.exe

- QBCFMonitorService.exe

- QBServerUtilityMgr.exe

- The following Intuit domains and ports must also be whitelisted

- Iintuit.com

- quickbooks.com

- Ports 80 and 443

Repair Your QuickBooks Installation

- Close QuickBooks and all related processes.

- Go to your computer’s Control Panel.

- Select Programs or Programs and Features.

- Find QuickBooks in the installed program list.

- Now, you have to Right-click on QuickBooks and then select Change/Uninstall.

- Navigate through the QuickBooks set up window and select Repair.

- Repairs must be followed according to the on-screen instructions.

- Once the repair is completed then you can restart your computer and try working with the payroll services of the QuickBooks.

Run the QuickBooks File Doctor

- This is a program that solves a lot of problems by looking toward solving corruption in data and network connectivity problems.

- To do so, you can have the Intuit website download the QuickBooks Tool Hub, which contains File Doctor.

- Open the QuickBooks Tool Hub and install it.

- At this step, you will select the Company File Issues tab, and from there, you will click Run QuickBooks File Doctor.

- Select the company file against which you want to browse to perform damage diagnosis against file damage and network connectivity.

- Allow the File Doctor to diagnose and try to repair any issues that are detected by following the onscreen instructions.

Rename the EntitlementDataStore.ecml File

- The EntitlementDataStore.ecml file stores licensing information for QuickBooks. However, on some occasions, connectivity problems can be caused by damaged or corrupted entitlement data.

- Close QuickBooks and all related processes.

- For this, open Window -> Open File Explorer -> go to the following directory C:\ProgramData\Intuit\Entitlement Client\v [version number] (replace [version number] with your QuickBooks version number, e.g., v8 for QuickBooks 2018)

- Locate the EntitlementDataStore.ecml file.

- Right-click on the file and select Rename.

- Rename the file to EntitlementDataStore.ecml.old.

- Restart QuickBooks. Reactivating your QuickBooks license is something you may be requested to do in most cases. The touch screen will guide you through activating again.

Perform a Clean Install of QuickBooks Desktop

- However, if none of the above steps solve the issue, a QuickBooks Desktop fresh install may be necessary. It means completely uninstalling QuickBooks and reinstalling it.

- Make sure you have a copy of your company file before performing a clean install.

- The QuickBooks Clean Install Tool can be downloaded from the Intuit website (use the clean and repair link under the Support and Downloads section of the QuickBooks product page listed on the right). This is a tool that aids in getting rid of all components of QuickBooks from the system.

- Go to the Clean Install Tool instruction page.

- After completing the uninstalling process, restart the computer.

- From the Intuit website, download the newest file installation for your QuickBooks edition.

- Install the one from the QuickBooks CD & reinstall it as explained.

- Restores the company file from the backup after finishing the installation process.

Contact Intuit Payroll Support

- If the error still persists, after making all the troubleshooting steps, then we are strongly suggesting that you reach contact Intuit Payroll support directly. The support team has the knowledge and tools to diagnose and resolve even the most complex of the payroll related issues like error PS038.

- There are times when you can give them the error code and the steps that you have already taken. They will then be able to grasp the problem easier, and solve the problem more efficiently.

Preventive Measures to Avoid Error PS038

The steps mentioned above can help solve Error PS038, but it is more in line to take preventive measures to avoid the occurrence of this error in the future.

- Regularly update QuickBooks: Only use the latest version of the software.

- Backup Company Files Frequently: Make regular backups to avoid data loss.

- Avoid Interrupting Payroll Updates: Maintain a stable internet connection when updating payroll.

- Verify and Rebuild Utilities should be run periodically: This prevents data integrity problems from arising.

- Train Staff: Make sure the users that do the payroll functions on the product are aware of optimal strategies.

Conclusion

During critical payroll periods, QuickBooks Error PS038 is a persistent and frustrating error to deal with. But figuring out the root causes of the issue and fixing the solution is the way to get you back taking action quickly. Fixing the error and preventing it from happening again is entirely possible by keeping your software up to date, maintaining data integrity, and adhering to best practice. If you need to do more complex situations, do not hesitate to contact QuickBooks Support or people who do payroll to protect your business operations.