QuickBooks Payroll won’t update issue is usually faced by users when they enter invalid or incorrect details in the paychecks. Poor internet connection, outdated QuickBooks version, damaged payroll file, expired payroll subscription, and corrupted company file are also a possible cause of this issue where QuickBooks Payroll update not working.

You must immediately resolve this issue to increase the productivity of QuickBooks Payroll users. It is important to update QuickBooks payroll to make employee payments and record taxes simultaneously. This error occurs along with an error message that indicates the underlying cause of this issue. In this article, you will get a complete step-by-step guide to resolve the QuickBooks Payroll update doesn’t work issue and its causes.

payroll won’t update

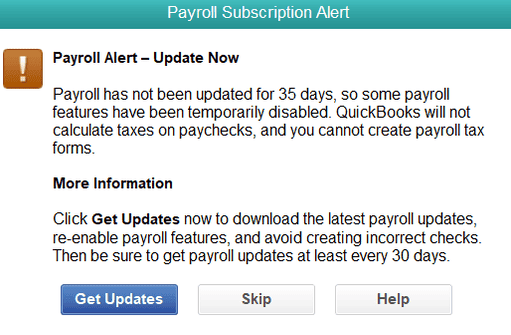

Payroll has not been updated, and some payroll features have been temporarily disabled.

However, upon attempting to access payroll functions, an error message requesting an update pops up on your screen. Payroll hasn’t been updated in 35 days, thus some features have been temporarily disabled. You are not able to generate payroll tax forms in QuickBooks, nor will it compute taxes on paychecks.

Causes of the QuickBooks Payroll Updates Not Working

The following are some of the most often cited causes of the QuickBooks Payroll update not working.

- An unstable or unreliable internet connection is one of the main causes of mistakes that occur when updating the payroll in QuickBooks.

- An error may also arise when updating the payroll if any crucial data files are missing.

- Online programs such as QuickBooks require essential Windows and Microsoft components to operate.

Read more: Update State Unemployment Insurance Rate in QuickBooks Online

Troubleshooting QuickBooks Payroll Update Not Working Issue

- Create a backup file of QuickBooks Desktop, and

- Update the QuickBooks software to its latest version.

Try the following methods to resolve the QuickBooks Payroll update not working.

- Send Payroll to Intuit

- Identify Stuck Paychecks

- Verify and Rebuild Data

- Toggle the stuck paychecks

- Allowing the Windows Permissions

- Modify the settings of the Internet

Solution 1: Send Payroll to Intuit

Once the above-mentioned prerequisites are done, refer to the solutions provided below:

- Go to the Employees tab, click on the My Payroll Service, and then click on the Send Usage Data option. Refer to the other steps if these options are not visible to you.

- Again, go to the Employees tab and click on the Send Payroll Data button.

- Click on the Send All option from the Send/Receive Payroll Data window. Submit the payroll service pin if there’s a prompt.

- You will get the payroll updates again if you have successfully received them from Intuit.

Solution 2: Identify Stuck Paychecks

The QuickBooks payroll update often doesn’t work properly because the paychecks are stuck. Here are the steps to identify the stuck paychecks and send them the Intuit:

- Navigate to the Edit option and click on Find.

- Click on the Advanced tab.

- Now, click on the Choose Filter section and click on Detail Level from the Filter list.

- Click on the Summary Only option.

- Navigate to the Filter list once again and keep scrolling. Once you find the Online Status toggle, click on it and select the Online to Send option.

- Click on Find, and the stuck paychecks will be displayed.

- Lastly, you will have to note the Number of Matches from the Find window.

After you follow the above-mentioned steps, move on to the 3rd solution.

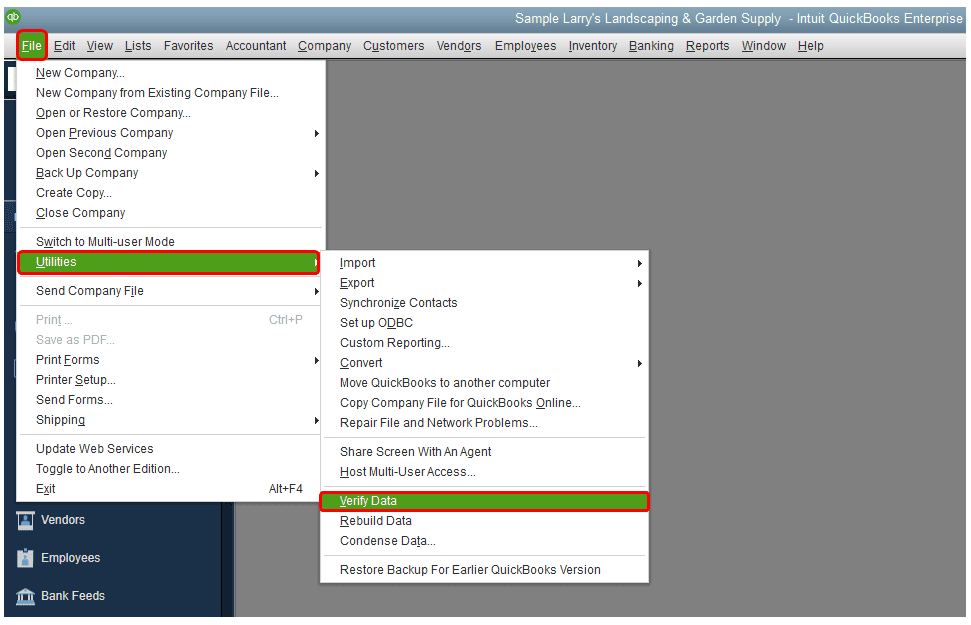

Solution 3- Verify and rebuild the data

Follow the steps below, once you find all unsent and stuck paychecks that have to be sent to Intuit.

- Click the file tab after launching QuickBooks Desktop.

- After selecting the utility option by scrolling down, select the “Verify Data” option. To end the other running Windows, click OK.

- Wait for a short while, as the validated data tool completes the required tasks.

- Proceed with the repair process and return to the File menu to access utilities if a program error occurs and a message instructs you to use rebuilt data to repair corporate files.

- You must try downloading the payroll update after you complete the previous steps.

- Verify whether the paychecks are sent or stuck.

Solution 4: Toggle the stuck paychecks

As a final resolution to fixing the QuickBooks Payroll Not Working error, you will have to toggle the stuck paychecks. Follow the steps given below to toggle stuck paychecks in QuickBooks.

- Open the stuck paychecks obtained in solution 2.

- Click on the Paycheck Detail button.

- Go to the Review Paycheck window from the Earnings section.

- Now, you must add the same earning item as the list’s previous earning item.

Tips: For example, add an earnings items naming it is Hourly Rate in the lists, if Hourly Rate is the list’s previous item.- A “Net Pay Locked” message will be displayed. Click on the No button.

- Verify that the net pay and tax amounts have not changed. Once verification is done, hit the OK button.

- Click on the Yes button if a Past Transaction message appears.

- To close the paycheck, select the Save & Close option.

- When the Recording Transaction warning appears, click on the Yes button.

- Reopen the paycheck. Click the option named “Paycheck Details”.

- In the Earnings section, remove the earnings items you recently added.

- Verify that the net pay and tax amounts have not changed. Click on the OK button.

- Now, you will have to repeat this process for each stuck or unsent paycheck found in Solution 2.

- After you have fixed the issue of each unprocessed paycheck, try downloading the tax table update once more.

Read more: Fix QuickBooks Desktop Subscription has Lapsed

Conclusion

When you are resolving the QuickBooks Payroll update not working issue, it is crucial to ensure smooth payroll processing and accurate tax records. By addressing the potential causes such as incorrect paycheck details, network issues, outdated software, or corrupted files, users can resolve the error effectively. Following the step-by-step solutions outlined such as Windows update, internet connection, verifying and rebuilding data, and upgrading the payroll version will help restore functionality. Timely resolution of this error will enhance the productivity of QuickBooks users, ensuring seamless payroll operations and compliance with tax requirements. In the above article, we explained all the causes and how to overcome from QuickBooks Payroll not updating issue. But still, if you are not able to overcome the issues then contact us on our toll-free number.

Frequently Asked Questions

Two updates have been released addressing the termination of payroll services for QuickBooks Desktop (QBDT). First, QBDT 2021 software will be removed altogether after May 31, 2024. Comprising all 2021 editions of QuickBooks Enterprise Solutions v21, QuickBooks Desktop Pro, QuickBooks Desktop Premier, and QuickBooks Desktop for Mac.

Updates may not function properly due to firewall or internet security settings. Check the settings for your personal firewall and Internet security software. It is necessary to activate ports 80 and 443 and grant access to the aforementioned files: the file AutoBackupExe.exe

The QuickBooks Payroll update not working issue can occur due to a variety of factors. Common causes include entering invalid or incorrect details in paychecks, poor internet connectivity, or using an outdated version of QuickBooks. Additionally, a damaged payroll file, an expired payroll subscription, or a corrupted company file can all contribute to this error.

If the QuickBooks Payroll updates not working error persists after trying solutions like sending data to Intuit or verifying and rebuilding your data, you may need to toggle the stuck paychecks. After completing the process of toggling the paychecks, try downloading the payroll update again. This should address any issues preventing the payroll update from working properly.

Errors Related to the Failure of QuickBooks Payroll Updates…